Back

16 Jul 2018

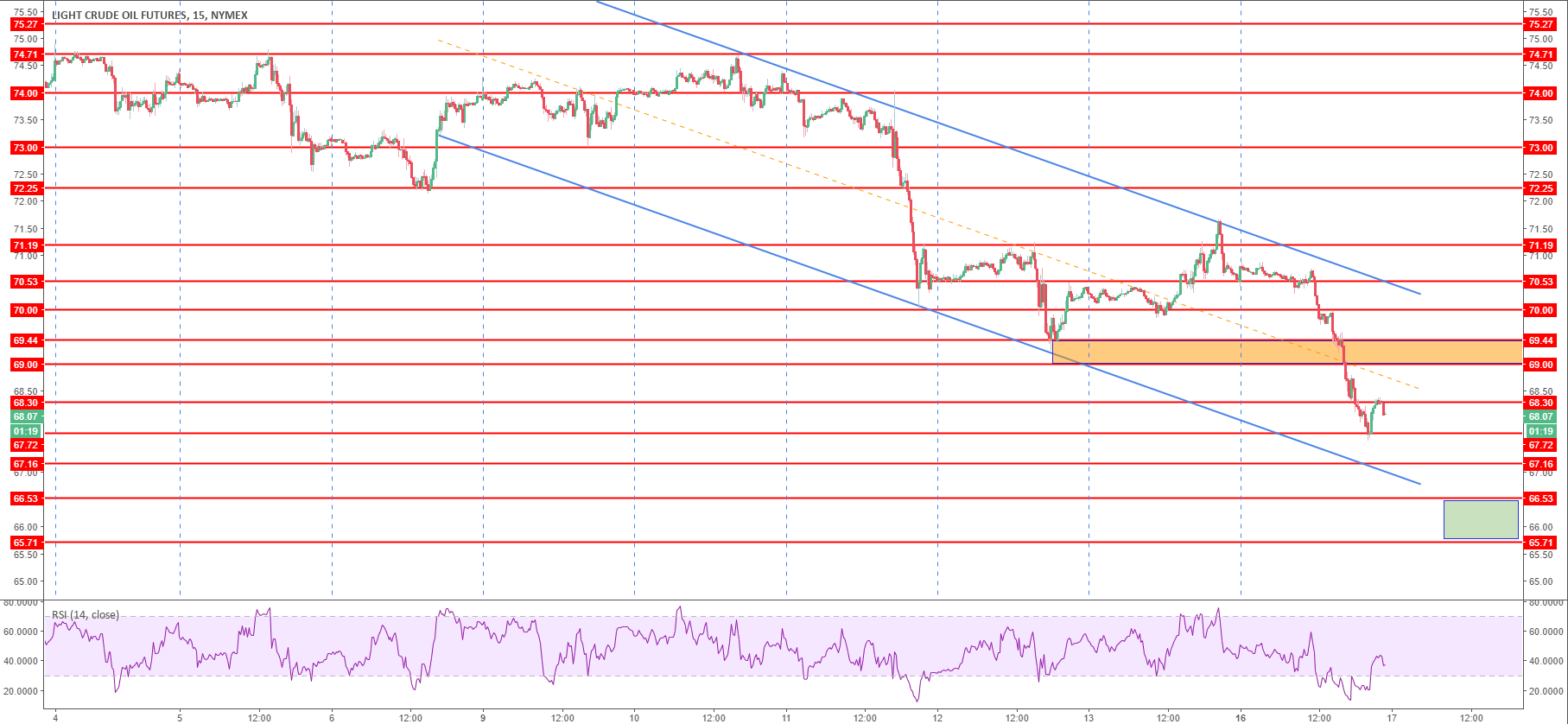

Crude Oil WTI Technical Analysis: Bears did it again - Oil down almost 4%

- Crude oil extended the bear trend by almost 4% this Monday as the pullback up above 71.00 last Friday was fairly weak and was possibly indicative of lower prices.

- Crude oil is now consolidating the strong move lower at around $68.00 a barrel. The pullback up might extend to 69.00-69.44 area. However, since the bear trend is so steep pullbacks might be very shallow.

- Targets to the downside can be located near 66.53, June 20 high and 65.71, June 22 low.

Crude oil WTI 15-minute chart

Spot rate: 68.00

Relative change: 3.86%

High: 70.84

Low: 67.56

Trend: Bearish

Resistance 1: 68.30 demand level

Resistance 2: 69.00 figure

Resistance 3: 69.44 June 25 high

Resistance 4: 70.00 figure

Resistance 5: 70.53 May 24 low

Support 1: 67.72 June 26 low

Support 2: 67.16 June 14 high

Support 3: 66.53 June 20 high

Support 4: 65.71, June 22 low