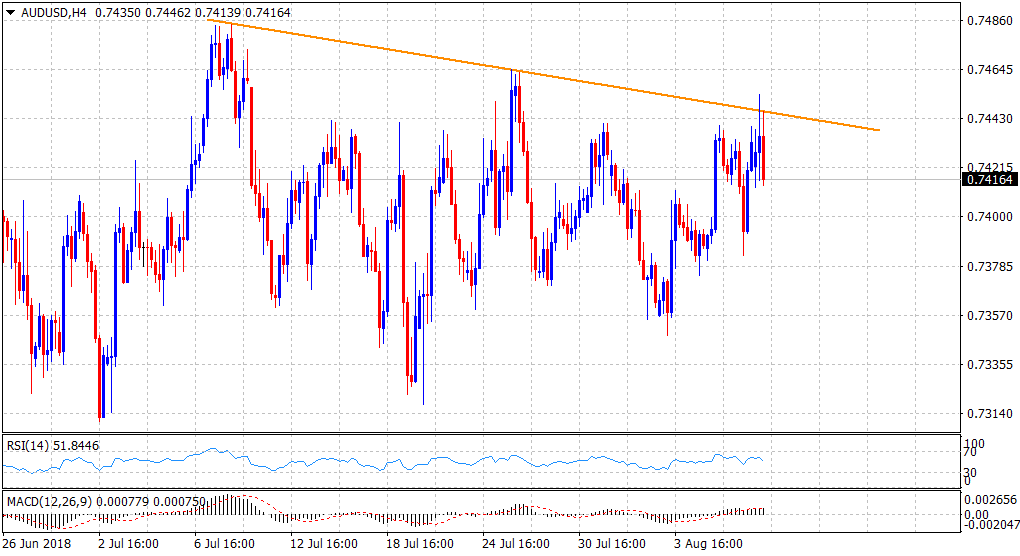

AUD/USD Technical Analysis: Struggles to break through a descending trend-line hurdle

• The pair's recent rise over the past one week or so once again stalled near a short-term descending trend-line hurdle, also coinciding with 55-day SMA.

• The pair remains within an eight-week-old broader trading range and diverging technical indicators on the daily/4-hourly chart also fail to support any firm directional bias.

• Hence, it would be prudent to wait for a convincing break in either direction before traders start positioning for the pair's near-term trajectory.

AUD/USD 4-hourly chart

Spot Rate: 0.7416

Daily High: 0.7453

Trend: Range-bound

Resistance

R1: 0.7450 (55-day SMA)

R2: 0.7484 (July 9/10 swing high)

R3: 0.7500 (psychological round figure)

Support

S1: 0.7400 (round figure mark)

S2: 0.7383 (overnight swing low)

S3: 0.7359 (S2 daily pivot-point)