Back

30 Aug 2019

EUR/CHF Technical analysis: Above 1.09, eyes falling trendline resistance

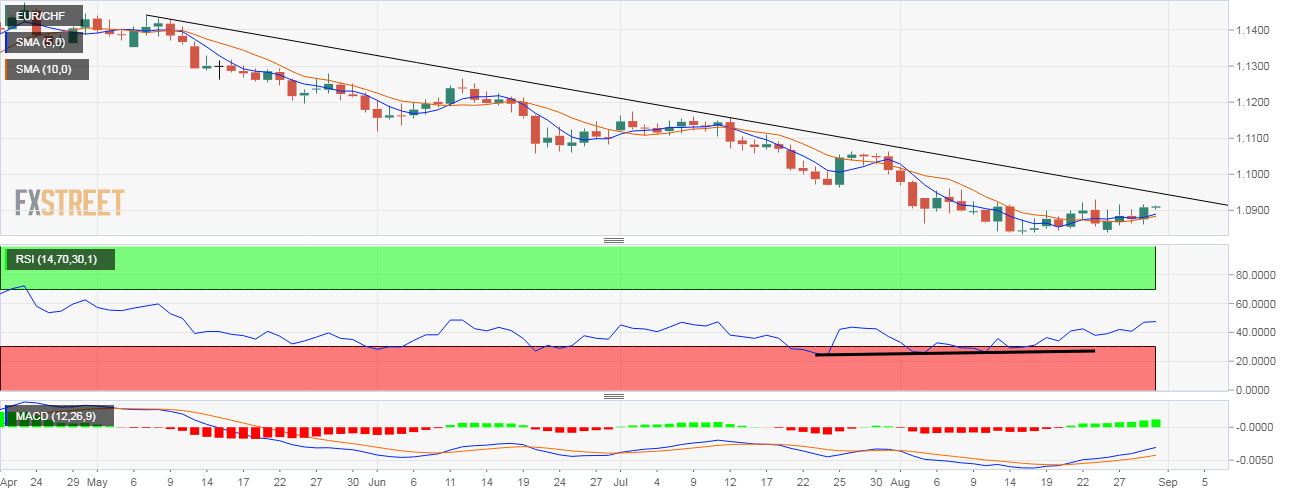

- EUR/CHF's daily chart indicators have rolled over in favor of the bulls.

- The pair could test the trendline falling from the May 7 highs.

EUR/CHF closed above 1.09 on Thursday and could test the resistance of the trendline sloping downward from May 7 and July 12 highs by today's NY close.

The pair's move above 1.09 has validated the bullish divergence of the 14-day relative strength index. The moving average convergence divergence histogram is printing higher bars above the zero line, a sign of strengthening bullish momentum,

Further, the 5- and 10-day moving averages (MAs) are bottoming out.

So, the stage looks set for a rise to the falling trendline resistance, currently located at 1.0947. As of writing, As of writing, the pair is trading at 1.0911.

Daily chart

Trend: Bullish

Pivot points