Back

20 Jan 2020

EUR/JPY Price Analysis: Bears taking charge within bullish structure

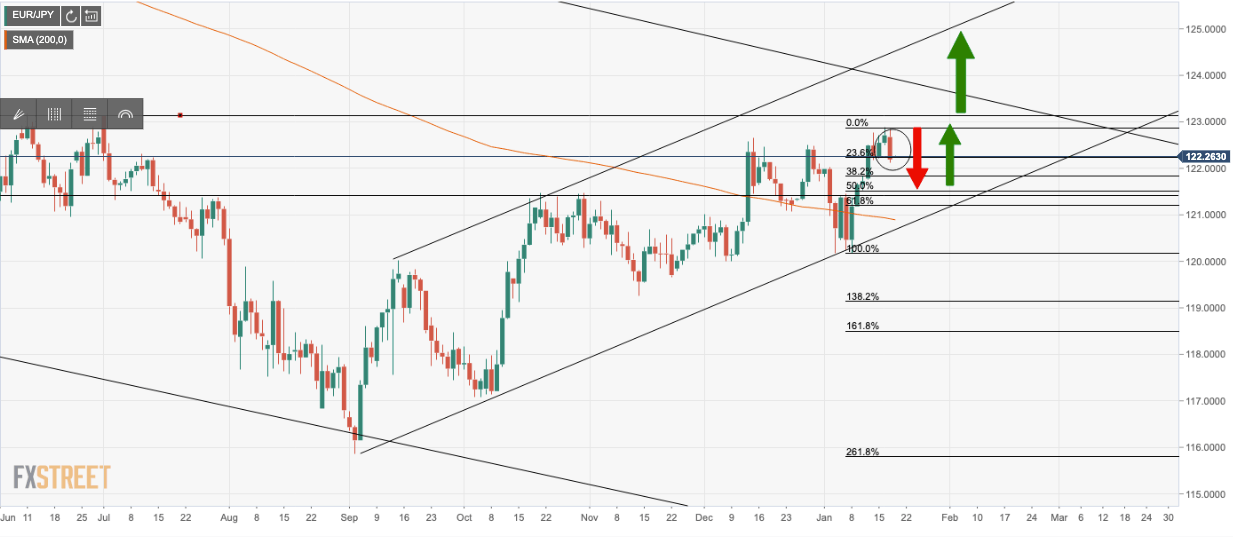

- EUR/JPY is in the hands of the bears and is at risk of a test back to a 50% mean reversion point.

- Bulls will look to buy dips in a constructive bullish channel.

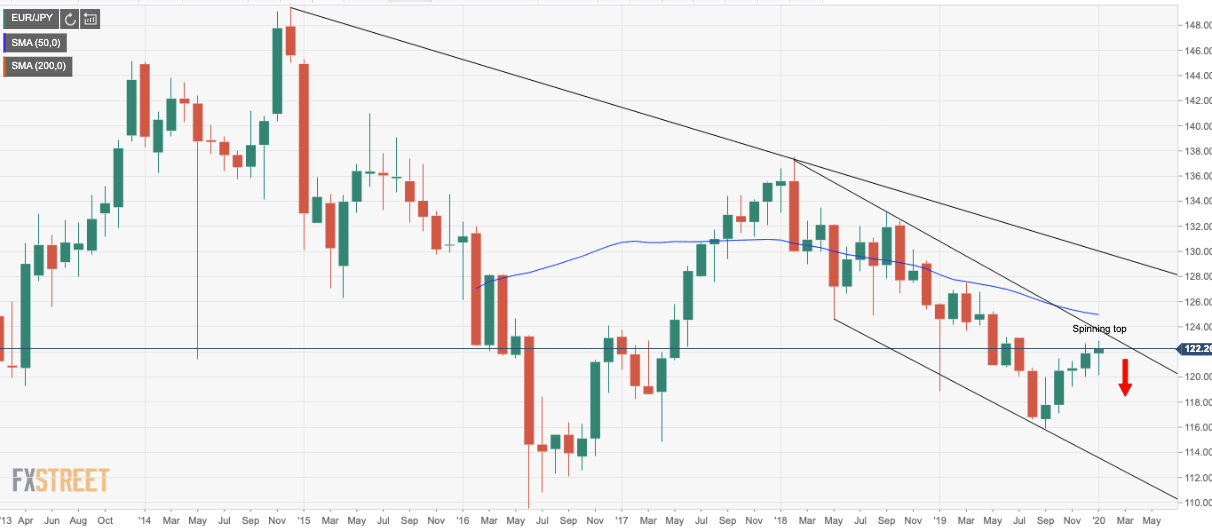

EUR/JPY has met the top of the downside channel and sellers will be looking to add to the overall downtrend, trading with the trend, encouraged by the bearish spinning top candle formation with price submerged below the 50-month moving average.

The daily chart is showing that bars are in control with bearish price action and candlestick formations. However, should the bulls hold either the 23.6%, 38.2% or 50% Fibo retracements of the latest rally, bulls may step in at a discount to target the next wave up chasing higher highs and lows towards the channel resistance.

EUR/JPY monthly chart

- Downside channel, price in close proximity to channel resistance.

- The spinning top below 50-month MA.

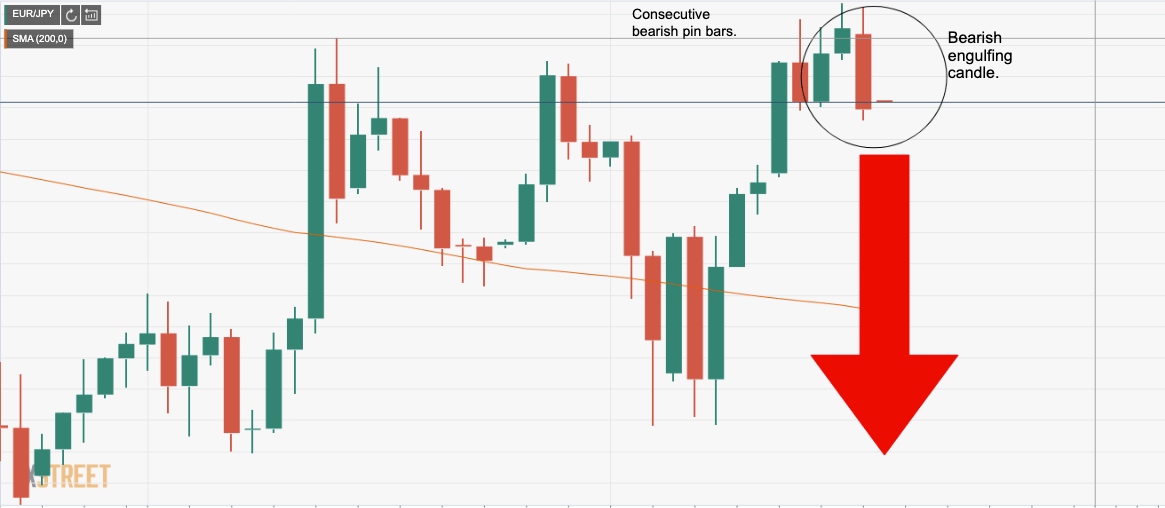

EUR/JPY daily chart

- The latest price action on daily chart is bearish.

- A series of bearish pin bars followed by a bearish engulfing candlestick.

EUR/JPY daily chart

- Bearish engulfing meets 23.6% Fibo support.

- Bears can target a 50% man reversion of the latest rally.

- Bulls can look to buy at discount to chase next higher.

- Failure of 50% fib retracement opens risk to 61.8% confluence support structure and 200-DMA lower down.

- Channel support last stop until 138% Fibo extension target, 119.00/20 confluence area