USD/CAD Price Analysis: Bulls taking in buy stop liquidity, but corrective wave expected (bearish rising wedge)

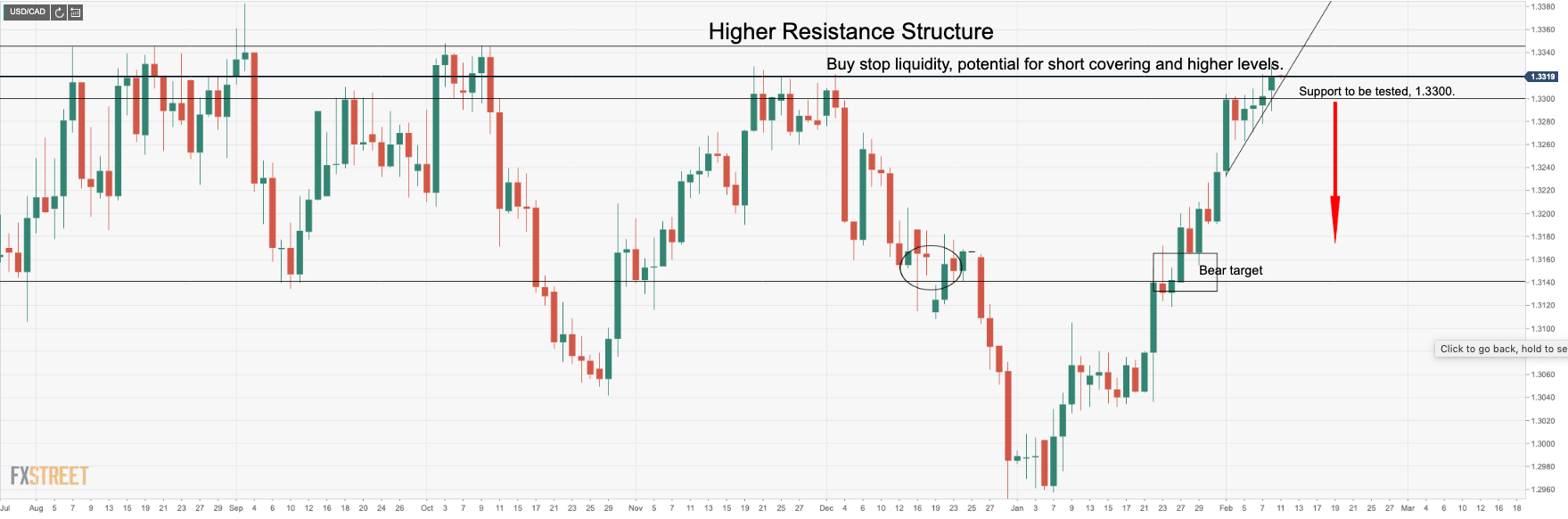

- USD/CAD is testing the stale bear's commitments and stops in an advanced extension of the upside correction.

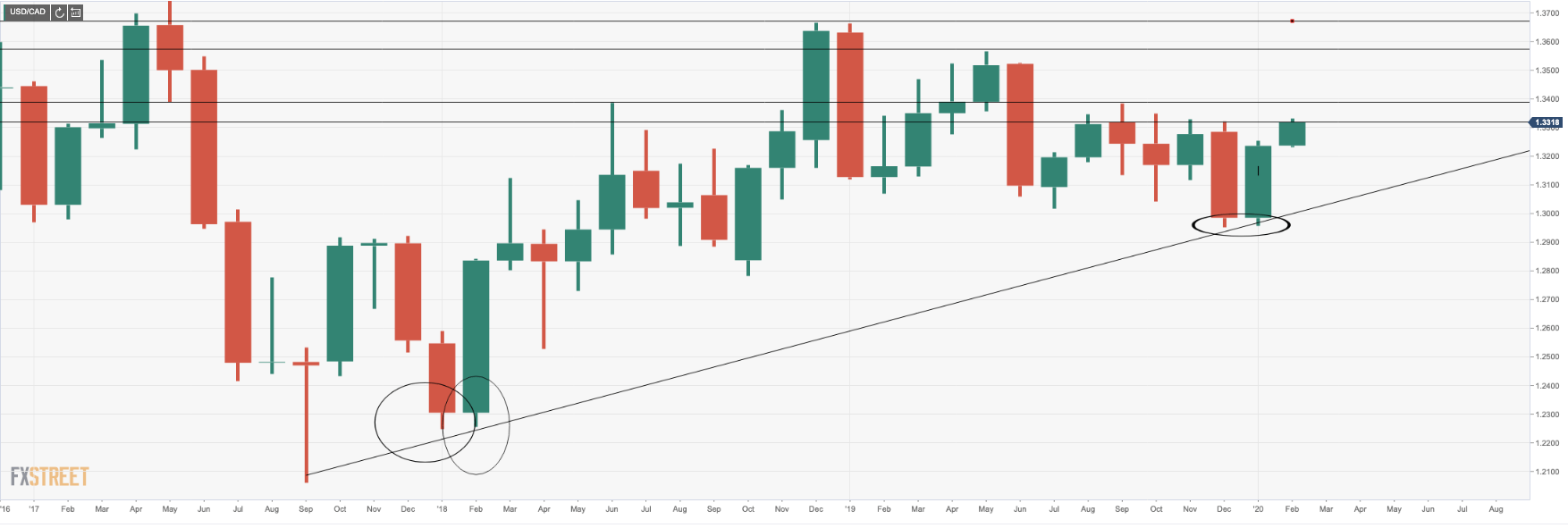

- USD/CAD has been otherwise been sting a long term support line from July 2014.

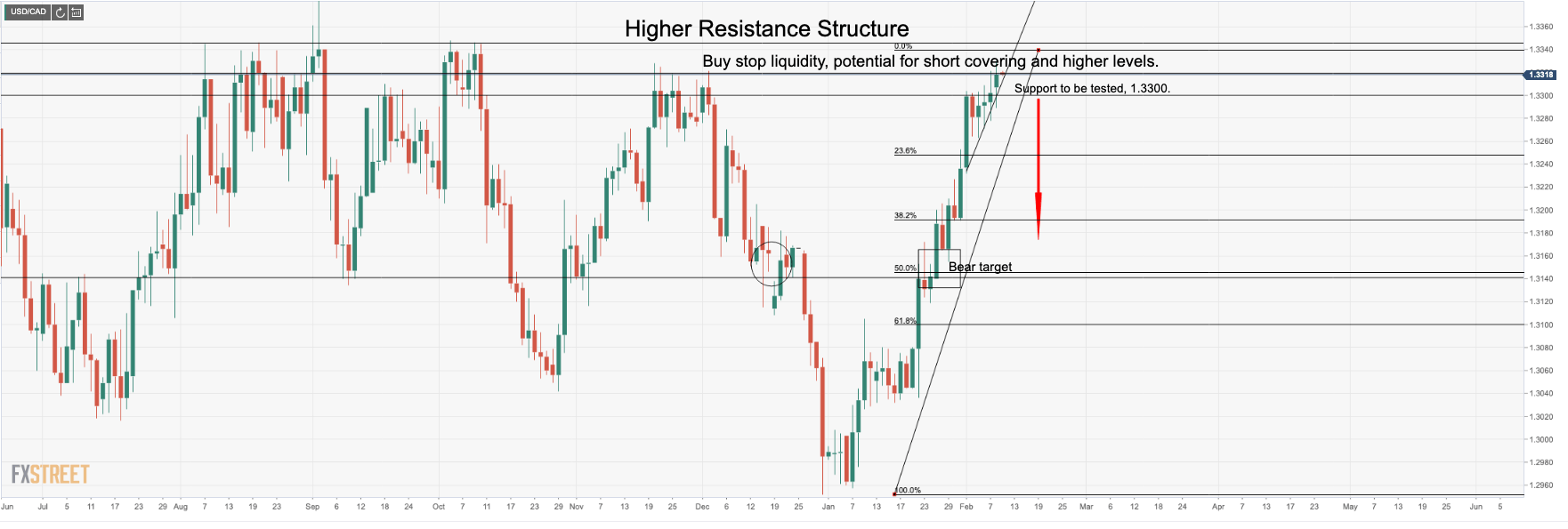

- USD/CAD could be seen to continue higher on a break of the monthly 23.6% Fibo with a target of the 1.3500.

- A pullback might be expected before the next convincing breakout and bullish impulses in a coronavirus risk-off environment.

The bigger picture

We are seeing trendline support holding and a third test is likely further ahead which leaves plenty of upside territory to target before the next meaningful test.

Potential for a final push to the upside, buy stop liquidity

However, for the meantime, we are seeing a very overbought last leg of a W-shaped corrective wave and reversal which would usually draw in bargain hunters looking for cheap CAD. However, the coronavirus and the price of oil continue to weigh and US data is supportive of USD.

We can see below the support structure that the bears need to break to confirm an opportunity for a bearish correction.

A 50% retracement opens prior gap and support/resistance area

On a presumed clear out of buy stops, we have set the Fibonacci retracements from a slightly higher top which draws in a 50% mean reversion target in line with a key support structure target. The rising wedge formation is also indicative of a bearish correction.