Back

4 Mar 2020

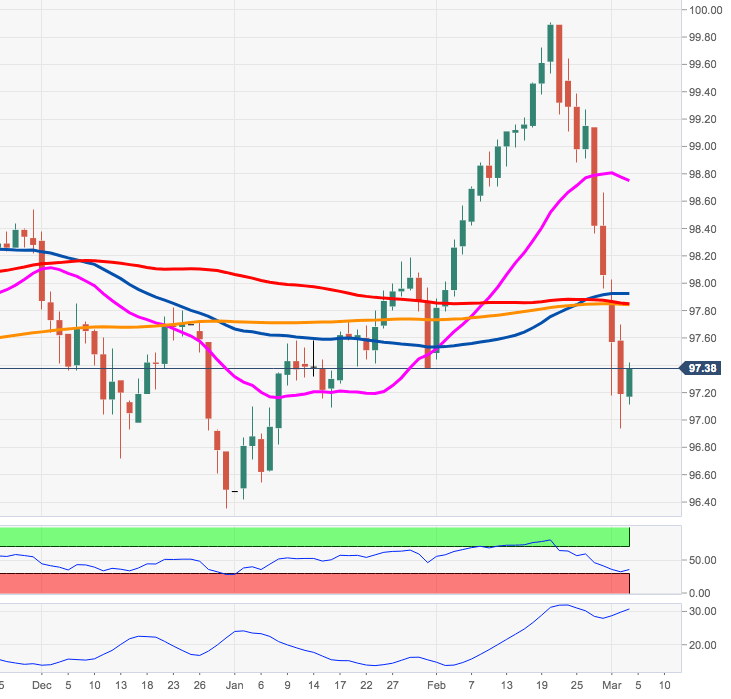

US Dollar Index Price Analysis: Stays bearish below the 200-day SMA

- DXY met some support in recent lows in sub-97.00 levels (Tuesday).

- While the 200-day SMA at 97.83 caps the upside, further losses are likely.

DXY is attempting a recovery following Tuesday’s fresh 2-month lows in the area below the key support at 97.00 the figure.

After breaking below some interim supports at Fibo retracements and the key 200-day SMA, the index has now opened the door to a deeper decline.

That said, a move to the December 2019 low at 96.36 should not be ruled out, particularly following Tuesday’s rate cut by the Federal Reserve and the probability of further easing in the near-term.

DXY daily chart