EUR/JPY Price Analysis: Bulls close in on both Wednesday and Tuesday session's POC, 61.8% Fibos eyed, 120.21/ 121.20

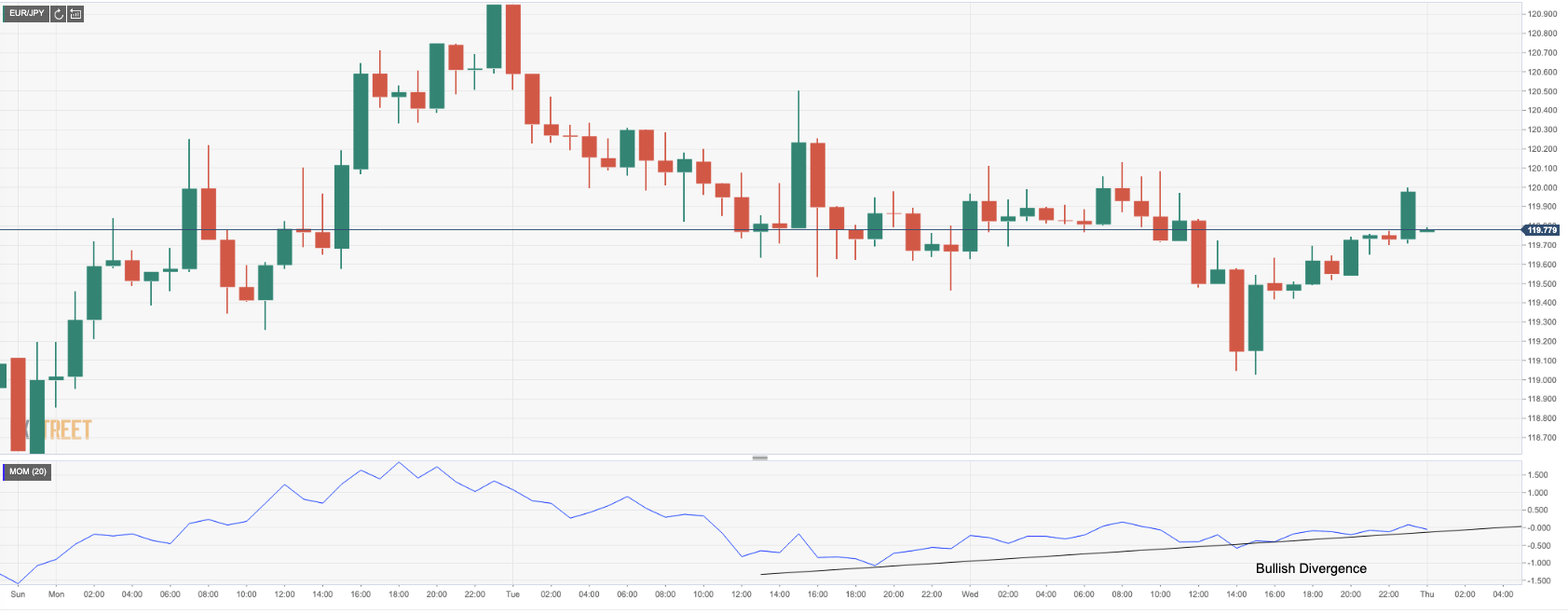

- Hourly divergence in the Rate of Change signalled on the 4th March lows.

- Bulls close in on both Wednesday and Tuesday session's POC.

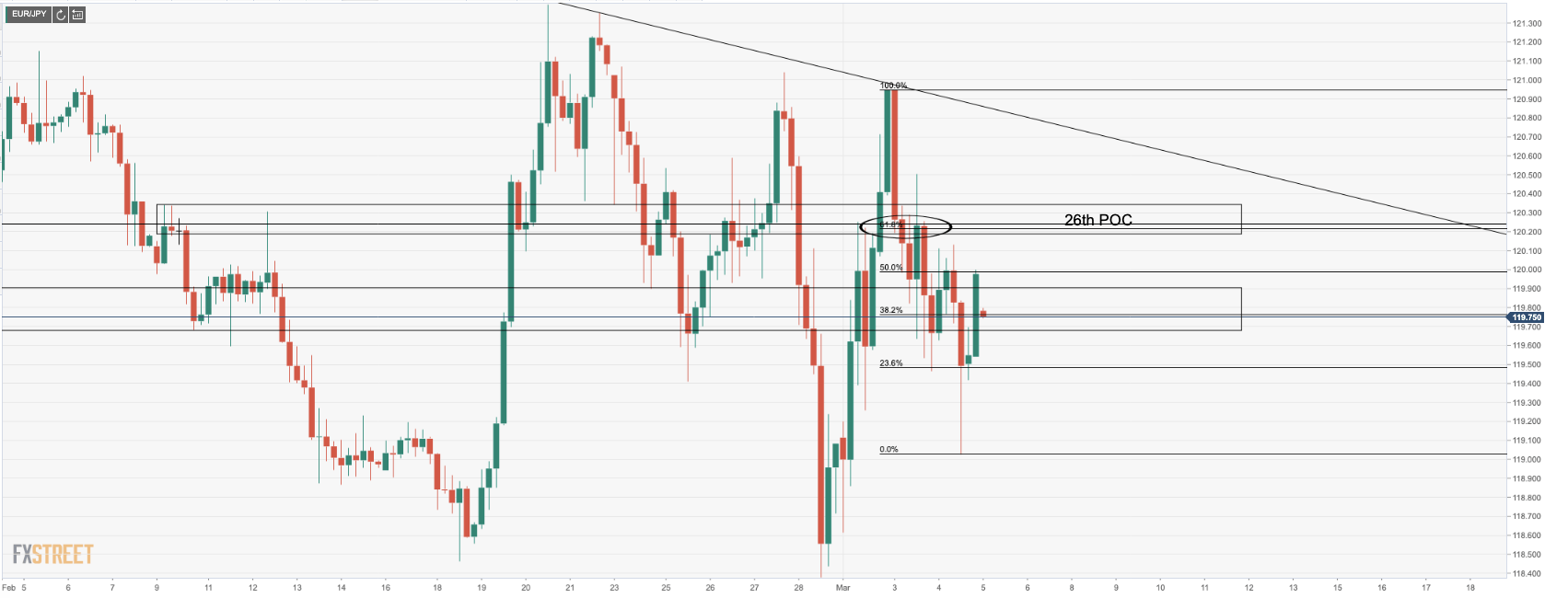

- Bulls propelled from support overnight from 27th Feb's POC.

- EUR/JPY has completed a 61.8% Fibonacci retracement of Wednesday's range.

- Bulls look to a 61.8% Fib target of the 2nd March highs at 120.21, 121.20 eyed on the top side.

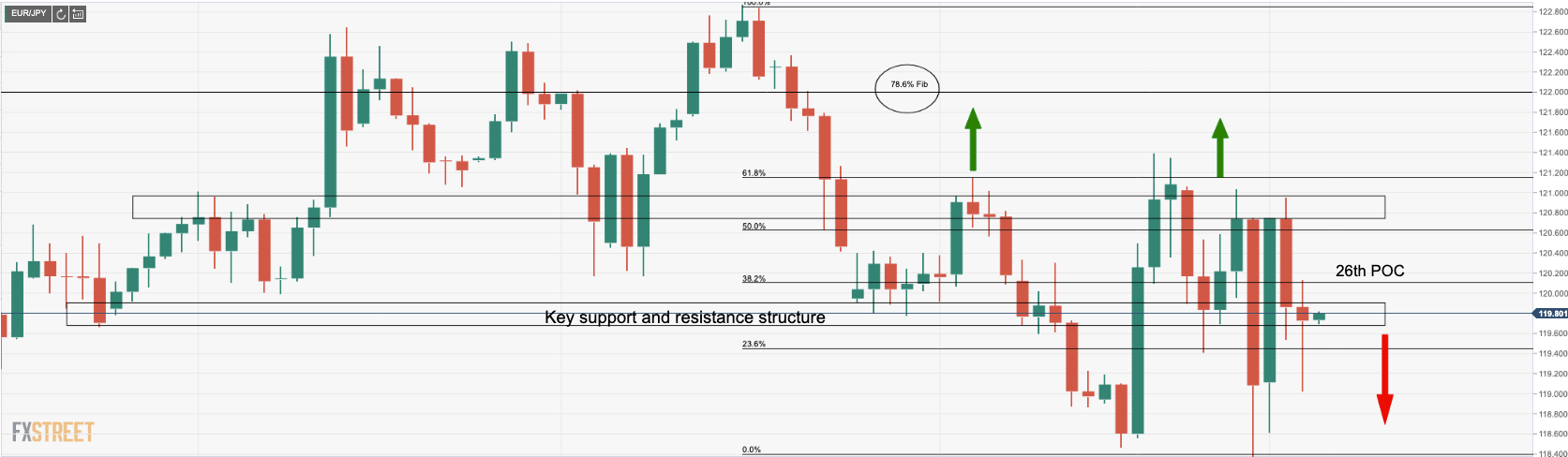

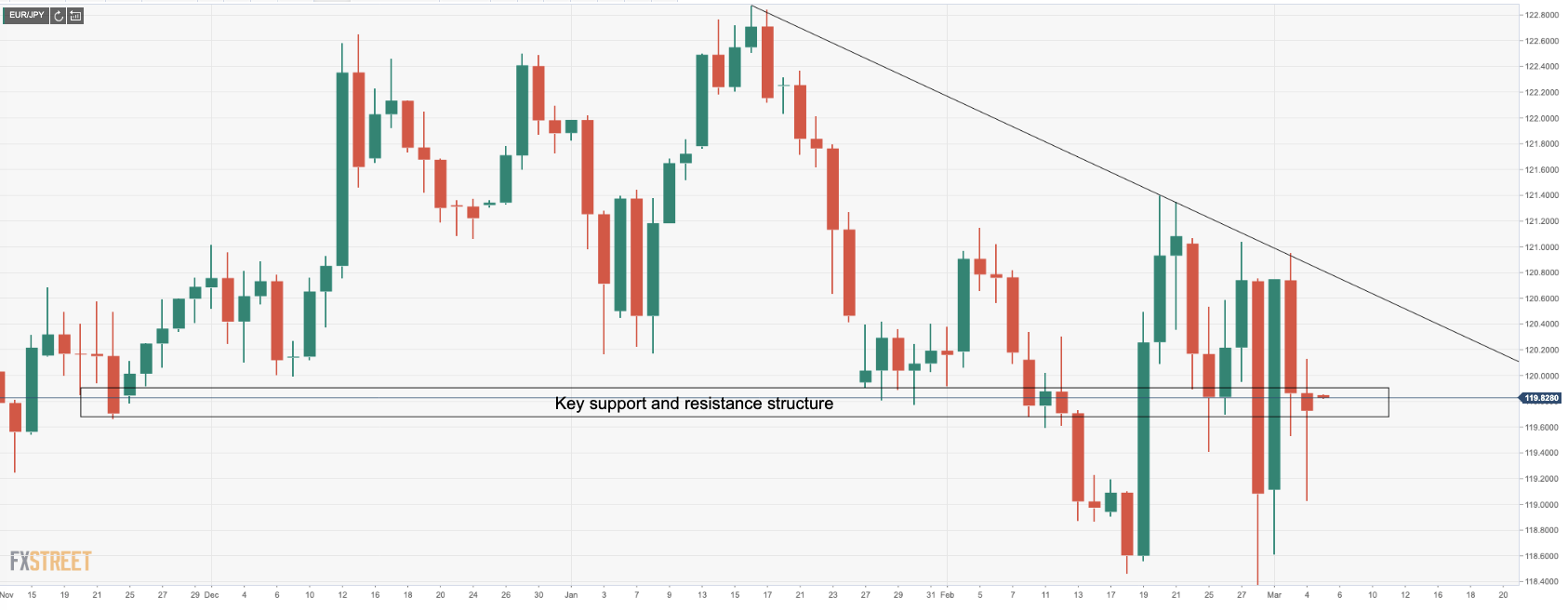

EUR/JPY has moved back to both Wednesday and Tuesday session's POC, finding support overnight from 27th Feb's POC. EUR/JPY has completed a 61.8% Fibonacci retracement of Wednesday's range and is 2 pips shy of a 78.6% retracement of the same range. There was an hourly divergence in the Rate of Change signalled on the 4th March lows leading to an upside correction. Considering the break of the hourly trendline resistance, an additional push at this juncture will take the price to a 50% Fib retracement ahead of a run back to the 25th and 26th Feb POC's confluence with a 61.8% Fib target at 120.21 of the 2nd March highs. On a wide outlook, the picture is bullish above and bearish below the structures drawn-out in the bottom chart. 121.20 eyed on the top side.

Divergence in momentum and rate of change

Testing daily structure, with room to the trendline

4-HR chart, bulls meet 50% retracement, target 61.8% Fibo target

Daily chart bullish above bearish below structures