US Dollar Index struggles for direction near 99.80, focus on data

- DXY briefly tests the 100.00 area on Tuesday, drops afterwards.

- Focus remains on the gradual re-opening of the US economy.

- ADP, EIA report coming up next on the docket.

The greenback, in terms of the US Dollar Index (DXY), remains well bid so far this week and approaches the key barrier at 100.00 the figure.

US Dollar Index looks to data, coronavirus

The index is looking to add to the optimistic start of the week on Wednesday in the 99.80 region after briefly testing the 100.00 neighbourhood on Tuesday.

In fact, the dollar stays bolstered by the demand for the safe haven universe at the beginning of the week, while market participants continue to assess the gradual re-opening of the US economy.

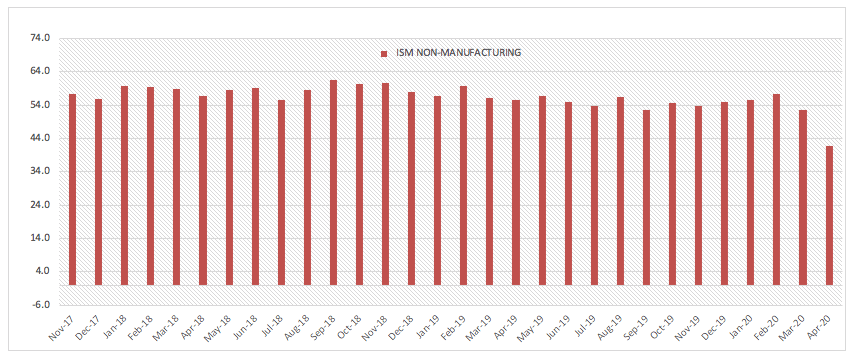

Also supporting the buck, the key ISM Non-Manufacturing surprised to the upside after falling less than estimated to 41.8 for the month of April (from 52.5).

In the US data space, the ADP report will be in the centre of the debate later in the NA session, with forecasts pointing to a loss of 20 million jobs in the private sector during April. In addition, the EIA will publish its weekly report on crude oil inventories.

What to look for around USD

The better note in the greenback pushed the index back to the boundaries of the 100.00 mark on Tuesday before losing some impetus, although it keeps navigating the upper end of the weekly range. In the meantime, investors have now shifted the attention to the US-China trade war, while the country keeps planning the gradual re-opening of the economy. Supporting the momentum around the greenback emerges the current “flight-to-safety” environment, helped by its status of “global reserve currency” and store of value. On another front, and following the FOMC event, the Fed is expected to stay on the loose end of the monetary policy stance, at least until the coronavirus crisis abates.

US Dollar Index relevant levels

At the moment, the index is losing 0.01% at 99.80 and faces the next support at 98.57 (weekly low May 4) followed by 98.35 (200-day SMA) and then 97.87 (61.8% Fibo of the 2017-2018 drop). On the other hand, a break above 99.97 (weekly high May 5) would open the door to 100.49 (78.6% Fibo of the 2017-2018 drop) and finally 100.93 (weekly/monthly high Apr.6).