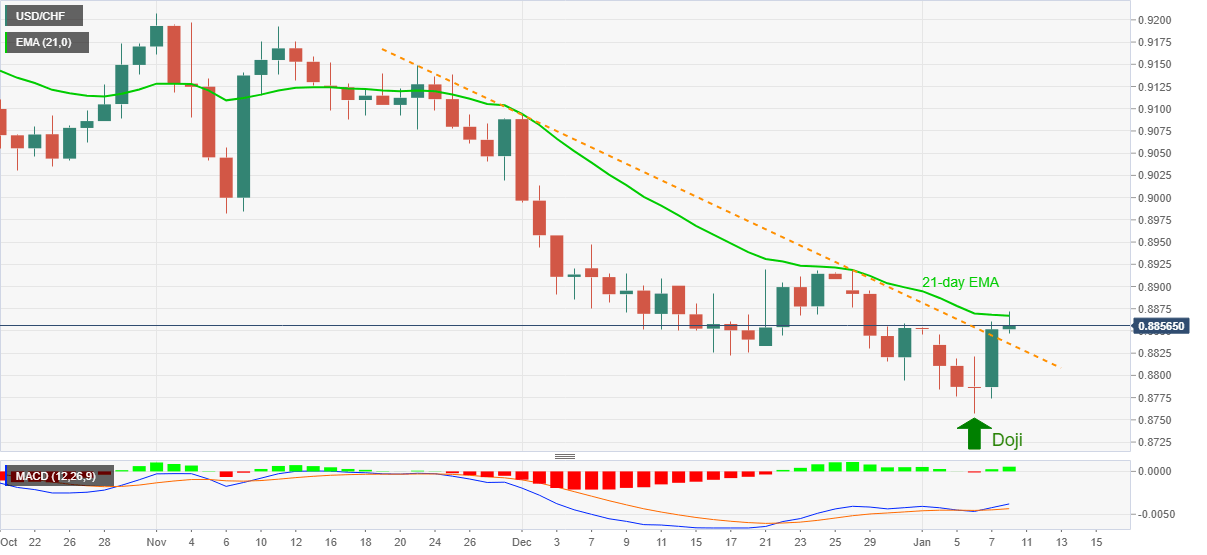

USD/CHF Price Analysis: 21-day EMA probes break of six-week-old resistance line

- USD/CHF keeps mild gains despite recent pullback from eight-day top.

- Wednesday’s Doji, bullish MACD and sustained break of short-term EMA favor buyers.

USD/CHF eases from a one-week high, also the intraday top, to 0.8856 during early Friday. Even so, the quote prints 0.06% gains on a day while keeping an upside break of a descending trend line from late-November.

In addition to the trend line breakout, bullish MACD and Wednesday’s Doji near multi-month low also back the USD/CHF upside.

However, 21-day EMA near 0.8870 guards immediate upside ahead of the 0.8900 round-figure and the late December peak close to 0.8920.

Should USD/CHF bulls manage to cross 0.8920, November low around 0.8985 will be in the spotlight.

Alternatively, a downside break of the stated support line, previous resistance, near 0.8835, will again aim for the 0.8800 threshold.

Though, USD/CHF sellers will fear entries unless defying Wednesday’s low with a downside break of 0.8757.

USD/CHF daily chart

Trend: Further recovery expected