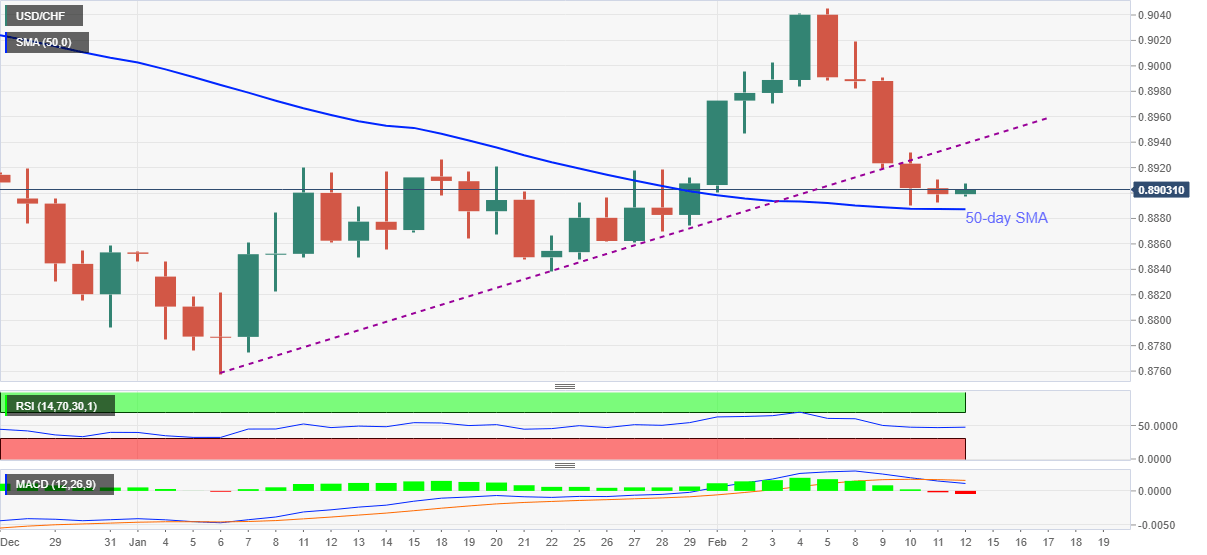

USD/CHF Price Analysis: Recovers from 50-day SMA to snap five-day downtrend

- USD/CHF wavers in a choppy range around 0.8900.

- MACD turns bearish but strong RSI and 50-day SMA probe sellers.

- Previous support line from January 06 adds to the upside barrier.

USD/CHF eases to 0.8903 while fading the early Asia recovery moves ahead of the European session on Friday. Even so, the quote remains inside the 20-pip range established since Wednesday.

While strong RSI conditions favor the quote’s latest bounce off 50-day SMA, the recovery moves will have a bumpy road considering the previous support and bearish MACD.

Hence, USD/CHF buyers may remain worried unless breaking the immediate resistance line, at 0.8938 now, following that the 0.8985 and the 0.9000 will challenge the further advances.

It should also be noted that the pair’s sustained run-up past-0.9000 threshold needs to cross the monthly high of 0.9045 to restore the bulls’ conviction.

Alternatively, a daily closing below the 50-day SMA level of 0.8887 will target the late January low near 0.8840 before directing the USD/CHF sellers towards the previous month’s low of 0.8757.

Overall, USD/CHF is likely to witness further consolidation of the latest losses before recalling the bears.

USD/CHF daily chart

Trend: Further recovery expected